PHOTO

The search for a buyer for the largest, multi-faceted wine business in the Alpine Valleys is continuing.

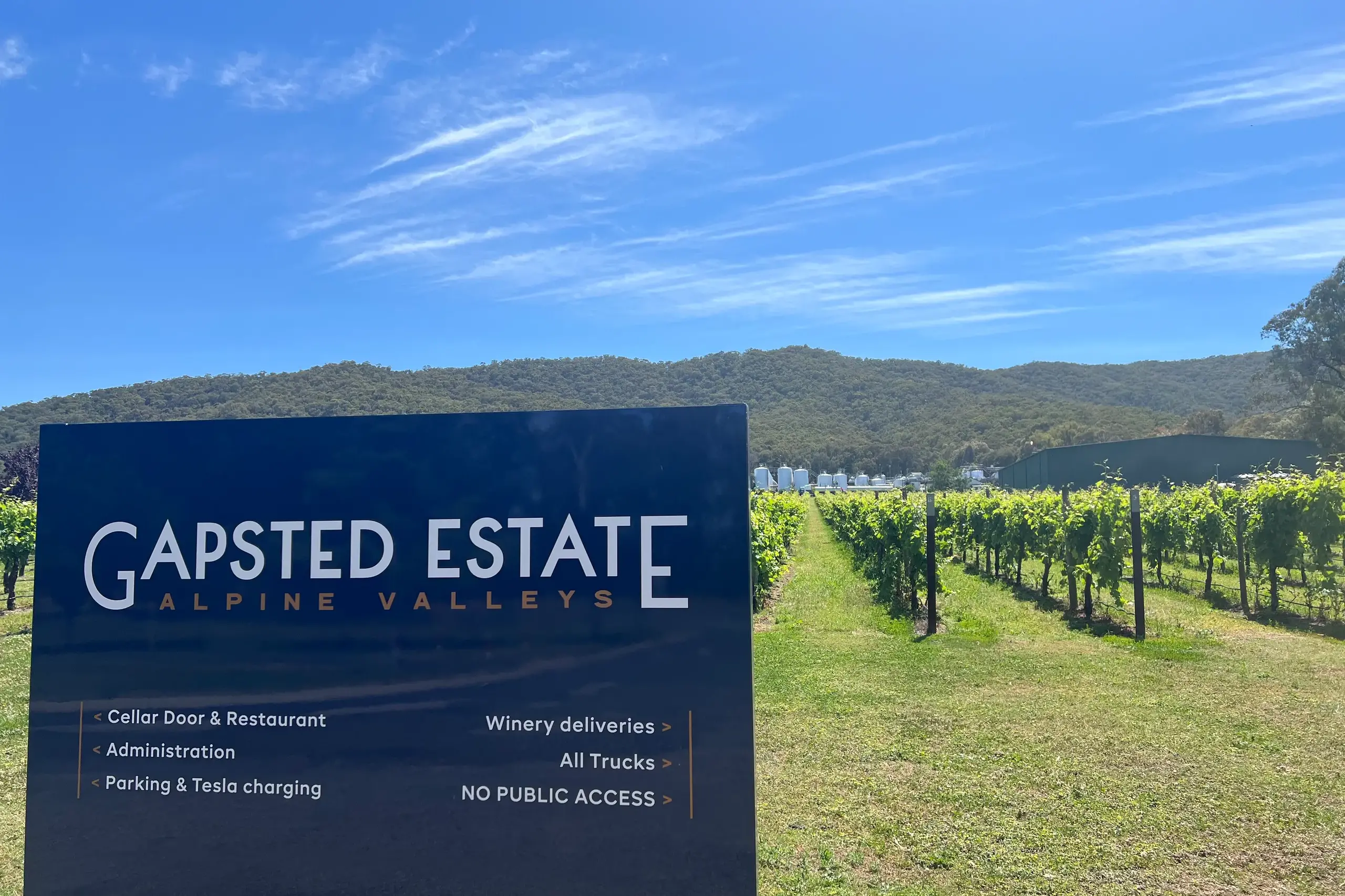

Victorian Alps Wine Company Pty Ltd (trading as Gapsted Estate) and Victorian Alps Winery Pty Ltd was placed in voluntary administration by its directors on 27 November, and on 10 December BDO Business Restructuring Partners Luke Andrews and Mathew Blum were appointed as Receivers and Managers.

Mr Andrews confirmed to the Myrtleford Times/Alpine Observer last week that a process for the sale of the business and assets has commenced and "the business continues to trade in the ordinary course while this process is undertaken".

He said the assets include freehold land of approximately 24.05 hectares at Gapsted, with 8.41 hectares under vine, with grape varieties including Chardonnay, Saperavi, Tempranillo and Petit Manseng.

"The site accommodates a fully operational winery with production facilities capable of processing approximately 6500 tonnes of grapes per annum, and wine storage capacity of approximately 8.2 million litres, together with additional oak barrel and red fermenter capacity," Mr Andrews said.

"The property also includes a cellar door and an on-site restaurant, with capacity for approximately 60 patrons for lunch service and up to 80 patrons for events."

He said further information will be made available to interested parties upon request at Gapsted.Estate@bdo.com.au.

Victorian Alps Wine Company Pty Ltd was established in 1997 by a group of independent grape growers from the Alpine and King valleys as a contract wine grape processing facility, and developed strongly branded Alpine Valleys wines and a vibrant cellar door and restaurant business in recent years.

Alpine Valley Vignerons president Stef Antonello told this masthead in December that the local wine industry is “absolutely hoping” a buyer for Gapsted Estate can be found, given its pivotal role as a wine grape processor and wine maker within the region.

“Certainly if they closed there would be a lot more grapes that won’t have a home," he said.

“We’re absolutely hoping someone buys them as an ongoing concern...it has great potential and just needs investment back into it.”